Alternative Investments

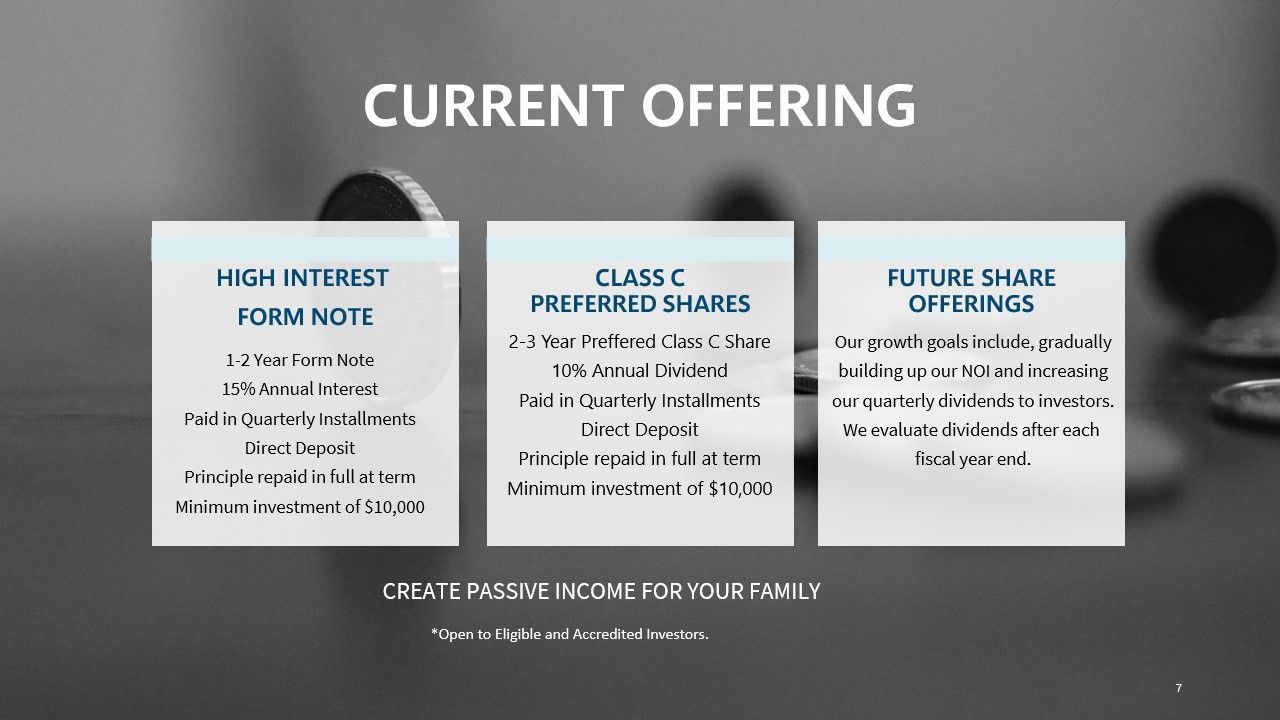

At Evergreen, we help families build wealth without your traditional bank investment. These alternate investments come with the potential for greater returns. Our current Class C Preferred Share offering is set at a 10% annual return.

Private alternative investments are not a traditional investment through a bank. These investments include real estate assets that use a crowdsource funding model to purchase residential and commercial real estate properties.

On your own it may be difficult to purchase and manage residential and commercial property investments, but collectively through Evergreen, we can.

Evergreen selects and manages the investment properties and pays out a strong return to shareholders. As the business profits, so will our investors.

Frequently Asked Questions

-

How secure is the investment?

As a corporation, Evergreen selects and invests in residential and commercial properties in Southwestern Ontario. This is a market we know well. These are properties you may drive by every day. Market values may fluctuate without causing much concern, as we have flexibility in when to buy and sell. We work hard to make sure our properties are well-managed and have a strong positive cash flow.

-

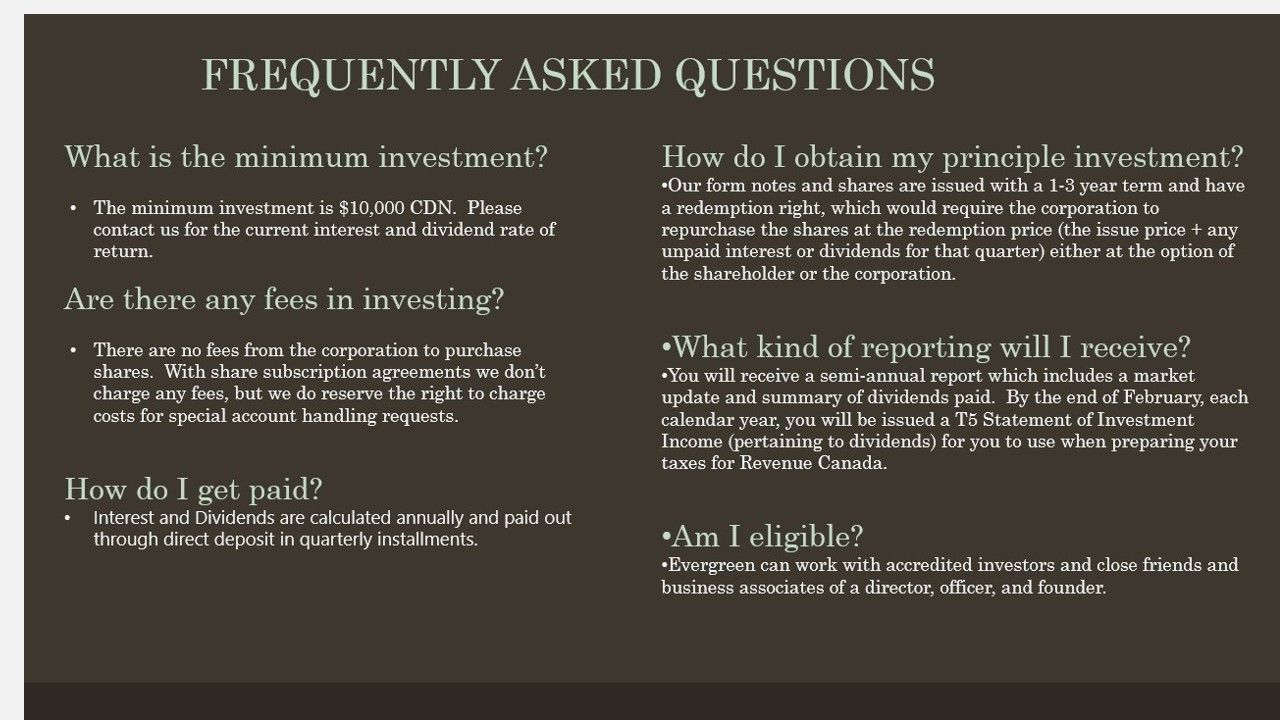

What is the minimum investment?

The minimum investment is $10,000 CDN. Please contact us for the current dividend rate of returns.

-

Are there any fees in investing?

There are no fees from the corporation to purchase shares. With share subscription agreements we don’t charge any fees, but we do reserve the right to charge costs for special account handling requests.

-

How do I get paid?

Dividends are calculated annually and paid out through direct deposit in quarterly installments.

-

What is a dividend?

Dividends are taxed at lesser rates than employment income. The dividend tax credit reflects that some taxes have already been paid at the corporate level. Taxpayers who hold Canadian dividend-paying stocks can be eligible for the dividend tax credit in Canada. This means that dividend income will be taxed at a lower rate than the same amount of interest income.

-

What is an alternative investment product?

Private alternative investments are not a traditional investment through a bank. These investments include real estate assets that use a crowdsource funding model to purchase residential and commercial real estate properties. On your own it may be difficult to purchase residential and commercial properties, but collectively, through Evergreen, we can.

-

How do I obtain my principle investment?

Our shares are issued with a 2-5 year term and have a redemption right, which would require the corporation to repurchase the shares at the redemption price (the issue price + any unpaid dividends for that quarter) either at the option of the shareholder or the corporation.

-

What kind of reporting will I receive?

You will receive a semi annual report which includes a market update and summary of dividends paid. By the end of February, each calendar year, you will be issued a T5 Statement of Investment Income (pertaining to dividends) for you to use when preparing your taxes for Revenue Canada.

-

Am I eligible?

Evergreen can work with accredited investors and close friends and business associates of a director, officer, and founder. See who qualifies for the Private Issuer Certificate below.

SCHEDULE “A” - Private Issuer Certificate

The Subscriber represents and warrants that the Subscriber is:

Please select one or more of the following categories, as applicable.

- (a) a director, officer, employee, founder or control person of the Issuer;

- (b) a spouse, parent, grandparent, brother, sister or child of a director, executive officer, founder or control person of the Issuer;

- (c) a parent, grandparent, brother, sister or child of the spouse of a director, executive officer, founder or control person of the Issuer;

- (d) a close personal friend of a director, executive officer, founder or control person of the Issuer;

- (e) a close business associate of a director, executive officer, founder or control person of the Issuer;

- (f) a security holder of the Issuer;

- (g)an accredited investor (defined in NI 45‑106) (Instruction: please also initial one or more categories of accredited investor, as applicable, in Exhibit 1 attached hereto);

- (h)a person of which a majority of the voting securities are beneficially owned by, or a majority of the directors are, persons described (a) to (g);

- (i) a trust or estate of which all of the beneficiaries or a majority of the trustees or executors are persons described in (a) to (g); or

- (j) a person that is not the public.

What is an accredited investor?

An accredited investor is an individual who, either alone or with a spouse, beneficially owns financial assets having an aggregate realizable value that, before taxes, but net of any related liabilities, exceeds $1,000,000; or

An accredited investor is an individual whose net income before taxes exceeded $200,000 in each of the 2 most recent calendar years or an individual whose net income before taxes combined with that of a spouse exceeded $300,000 in each of the 2 most recent calendar years and who, in either case, reasonably expects to exceed that net income level in the current calendar year;

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton